Accountants for Entrepreneurial Business Owners

We give you peace of mind, real time visibility of how your business is doing and access to high level financial expertise to help you manage and grow your business.

Do you know the financial position and performance right this minute?

Are you sure you’re claiming all the tax reliefs you are entitled to and have certainty that all the VAT you’ve paid out is being reclaimed?

What would be the difference if you did?

Imagine knowing exactly which parts of your business were more profitable than others so that you can make decisions on where to plough your attention. Imagine knowing exactly who owes you what at any point in time so that you can put systems in place to chase debts and get the money in your account faster.

Imagine having accurate, real time management accounts showing you exactly where your business is every single month so that you can take action where required.

Imagine having a real time, moving forecast so that you know exactly what you cash commitments are 6m, 12m from now enabling you to plan ahead with comfort.

Imagine just not having to worry about the finance side of your business because you have someone in charge who manages it for you.

Cue, your very own Virtual Finance Office.

The benefits of a Virtual Finance Office

Bespoke financial support

The right level of financial support you need from bookkeeper to Finance Director and anything in between.

Tailored and cost effective

Tailored to your size and circumstances and more cost effective than employing your own in house finance team.

Access to high level FD input

Access to high level financial acumen and experience of a Finance Director at a fraction of the cost of engaging one directly.

No loss of cover

No loss of access during holiday periods.

Scale with you

Ability to scale services up and down as your business grows or declines.

Your finance partner

You can call or email us as much as you need to (no charging by the hour!) – we are an extension of your in house team

Are you the right fit for a Virtual Finance Office?

Does your accountant just do once a year accounts and taxes for you and not much more?

This is unfortunately common place! Year end accounts are about as much use to helping you grow your business as a chocolate teapot. Let’s face it, if you didnt have to do year end accounts if Companies House and HMRC didn’t ask you to, you simply wouldn’t do them.

Why? Because all they tell you about is history. It’s like trying to drive a car forward whilst constantly looking in the rear view mirror. What is far more useful is to have real time, on demand management accounts, forecasts and insights on the key numbers of your business.

These are the numbers that will give you a pulse on your business. That will tell you where you are making money and where you are not. That will tell you when you might run out of cash or be unable to meet payment obligations if incoming cash targets are not met. That will give you all the data you need to confidently steer your business in the direction you want it to go.

What does a typical finance function look like?

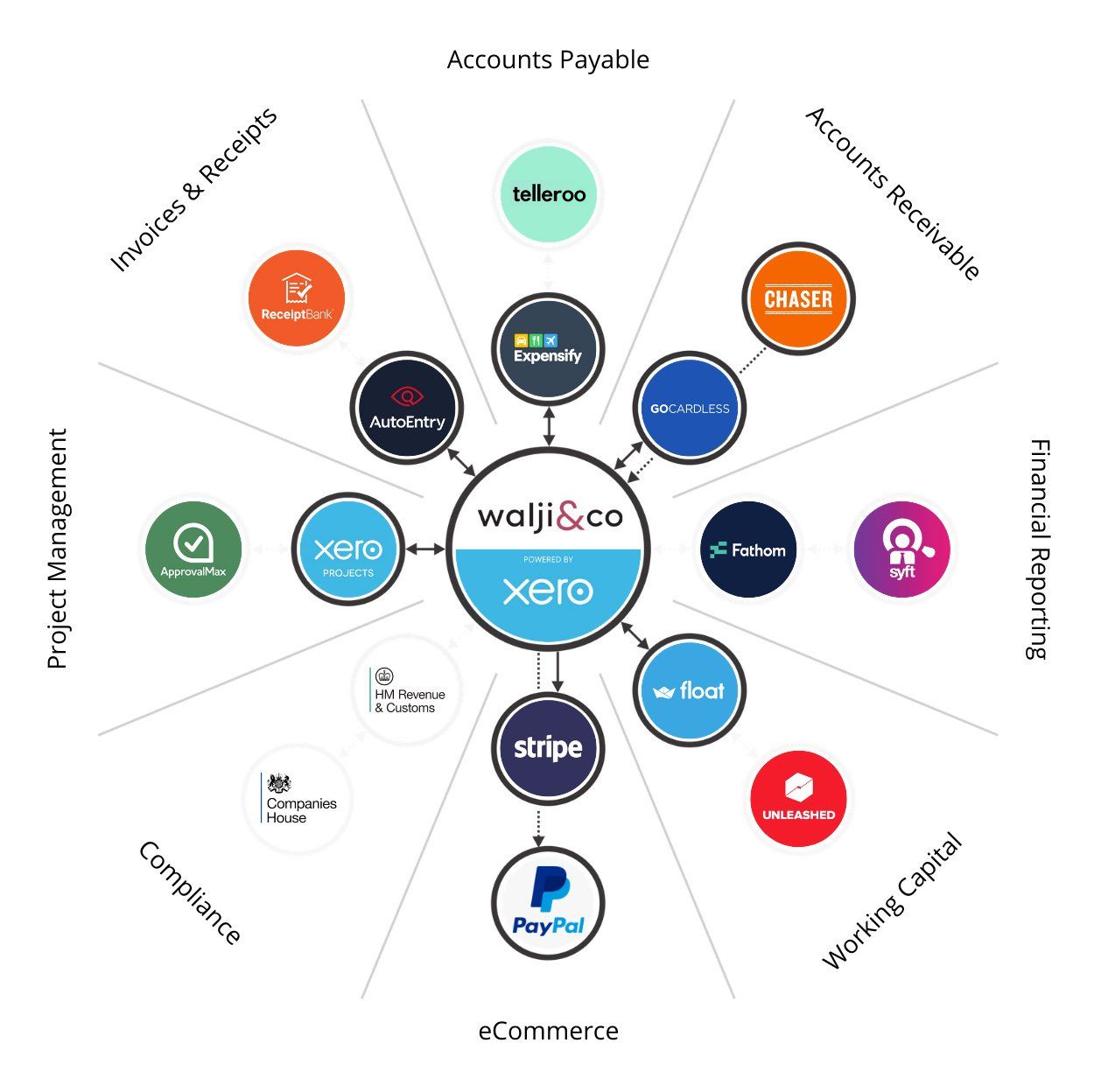

Most people think that they just need a ‘bookkeeper’. However, they often miss that the finance side of a business is made up of various different areas - often referred to as the ‘finance function’. The image below shows the areas of the finance function that can be systemised to run efficiently within the cloud - costing you less and giving you more time to focus on what matters.

Discovery Call

Sound like something that could help?

If you’re fed up with trying to run your business in the dark and not having someone with financial expertise at your side to support your business plans then click on the link below to book a discovery call to see if we can help