The most powerful lever in the profit equation

You can’t manage profit. Profit is simply an end result. It’s the end result of a series of processes.

It’s the business model.

Numbers drive that business model. When you fully understand your business model and how the numbers work you will be able manage and improve the drivers of profit.

Every business is different and will have its own unique business model and profit drivers. Nevertheless, for most businesses there is a generic model. This model has 9 drivers, so let’s explore that.

A model of your business

Profit is the end result of deducting costs from sales.

It looks like this:

PROFIT = SALES – COSTS

But that’s far too simplistic. We have to understand both sales and costs in more detail.

What drives costs?

Costs are made up of

fixed costs

and

variable costs. It’s important to differentiate between the two because they have a very different impact on your business model.

Variable costs – sometimes referred to as

direct costs – change in proportion to changes in sales. Typical examples are direct labour and the cost of raw materials.

Fixed costs, as the name suggests, don’t change (at least, not in the short term). Typical examples are premises costs, sales force salaries and administrative staff salaries.

Fixed costs are usually fixed in the short term, but over the longer term can vary. Whilst a 10% increase in sales is unlikely to have any impact, a doubling of the business may lead to the need to hire more administrative staff or larger premises.

Other forms of cost exist, such as

stepped costs, which are a form of fixed costs that jump in steps as business activity and sales increase.

For example, if you manufacture widgets and you increase your sales by 10% your variable costs also increase by 10%.

Your fixed costs probably won’t change with a small change in sales.

If your sales of widgets increase by a larger amount, say 50%, your direct costs would increase by 50%. Some of your fixed costs such as premises costs may continue to be unchanged.

But to generate that increase in sales of 50% the cost of your sales force is likely to rise (possibly by as much as 50%, or even more). Those costs will not vary directly with sales, but they will increase in steps.

Whilst you should be aware of different costs and how they react to changes in sales and business activities, splitting costs between variable and fixed will usually suffice. So, we’ll keep things simple.

So, our formula now becomes:

PROFIT = SALES – VARIABLE COSTS – FIXED COSTS

Have you spotted something about this formula?

This is how accountants set out your end of year financial statements. Go and check them out.

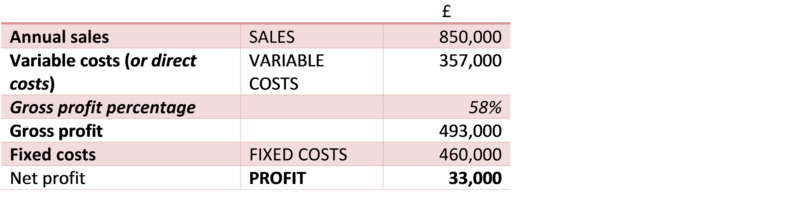

Here again is Eddie’s financial statement (I’ve just added the terms used in the above formula for clarity).

You’ll see that accountants simply add in a line for

gross profit

which simply means sales less variable costs (and often this is expressed as a ratio too, often referred to as gross margin):.

Whilst this analysis of a business provides some useful insights – measuring trends in these numbers over time and analysing changes in gross margins – it doesn’t go anywhere near far enough.

Let me explain why…

You could improve profit by focusing on fixed costs. The trouble is there is only so much fixed cost you can remove from a business before it has a seriously detrimental impact.

You almost certainly can’t halve your fixed costs without radically redesigning the whole business model. It’s quite hard to reduce fixed costs by 10% without harming the business in some way.

Whilst you should be mindful of costs at all times, improving this profit driver will only result in a relatively small improvement in profit.

It’s the same with variable costs.

Realistically, if you focus on reducing your fixed and variable costs you would probably achieve a 5% improvement in both, and for Eddie that would increase his profits from £33,000 to £73,850. Certainly worthwhile, but not

game-changing.

Unfortunately, this is where the advice from many accounting professionals stops. When asking for advice on how to improve profits, most focus on the cost drivers. The real power lies tucked away in the drivers of sales.

What drives sales?

The famous marketer, Jay Abraham, championed the idea of

“Three ways to grow a business”

which describes a powerful way of looking at how sales are made up.

He describes it like this:

SALES = NUMBER OF CUSTOMERS x AVERAGE AMOUNT OF EACH TRANSACTION x AVERAGE NUMBER OF TRANSACTIONS IN A YEAR

Let’s simplify the terminology into this:

SALES = CUSTOMERS x SPEND x TRANSACTIONS

From a marketing perspective, this is very powerful. Most business owners wanting to grow their business focus solely on the first component; winning more customers. And whilst there is nothing wrong with that, it limits what is possible.

For example, let’s imagine Eddie (who we first introduced in last week's article) wants to grow his business by 10%.

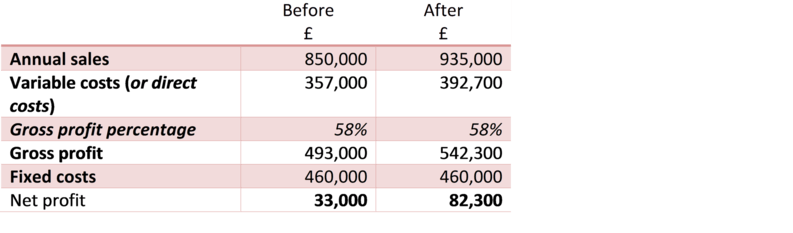

He could carry out some marketing activities to win 10% more customers. If he does that, his sales and profits would look like this.

Winning 10% more customers

I’m assuming here that fixed costs will not change. However, there are likely to be some additional costs in respect of the marketing, such as advertising or hiring a marketing consultant.

Consequently, the impact on bottom-line profit is likely to be a little less.

He could of course achieve exactly the same result if instead he puts some systems in place to increase the amount of money his existing customers spend with him each time they do business by 10%.

Increasing the average amount of each transaction has the same impact on sales.

Alternatively, Eddie could implement some strategies for getting his existing customers to buy more often each year by 10%, i.e. increase the average number of transactions in a year.

A 10% improvement in any one of these three drivers will increase sales by 10%.

However, marketers teach us that working on the second of those sales drivers is much easier because you already have an existing relationship with your customers. It’s much easier to sell more to an existing customer who knows you, than to acquire a new customer.

The power of synergy

What would happen if Eddie put in place some strategies and systems to increase each of those three sales drivers?

What if he acquired 10% more customers, and got his customers to spend more each time by 10% and by 10% more frequently?

What would be the overall impact on sales?

Not 10%. Much better than that.

And not 30% either.

It’s actually 33.1%.

What happens is each of the drivers interacts with each other and we get synergy. For this reason, you grow your business faster if you make small improvements in all the drivers, rather than focusing on just one thing, like winning new customers.

Putting this together

We now have 5 drivers of profit in our business model:

PROFIT = (CUSTOMERS x SPEND x TRANSACTIONS) – VARIABLE COSTS – FIXED COSTS

This is a much more useful model of a business. But we can take this a step further.

What determines the number of customers you have?

If you want to increase the profits of your business you could focus your attention on the first sales driver, number of customers. But what determines the number of customers?

We can break this driver into 3 separate components:

CUSTOMERS = CUSTOMERS LAST YEAR + (NUMBER OF SALES LEADS x SALES CONVERSION RATE) – CUSTOMER DEFECTION RATE

In other words, there are 3 things that drive the change in the number of customers:

1. Getting more sales leads (which is MARKETING)

2. Converting more of those sales leads into customers (which is SALES)

3. Reducing the number of customers that leave (which is CUSTOMER SERVICE)

Once again, we can model this mathematically and identify how a change in each of these drivers impacts on profit. A good accounting professional will be able to do this for you.

Why is the price driver different?

The second of Jay Abraham’s 3 ways to grow a business is the average amount of each transaction. In other words, what can you do to get customers to spend more money with you every time they do business with you?

This is very powerful.

But to build our mathematical business model we need to break this down into two separate components.

Essentially there are two ways of getting customers to spend more:

1. Buy more from you each time (for example, by creating some up-selling systems), and

2. Changing the price.

It’s important to consider these two separately because they each have a different impact on costs. Buying more of your products or services means variable, or direct, costs also go up.

Changing price has no impact on costs.

This is one of the reasons why, mathematically, price is the most powerful lever in the profit equation. To illustrate, let’s go back to Eddie.

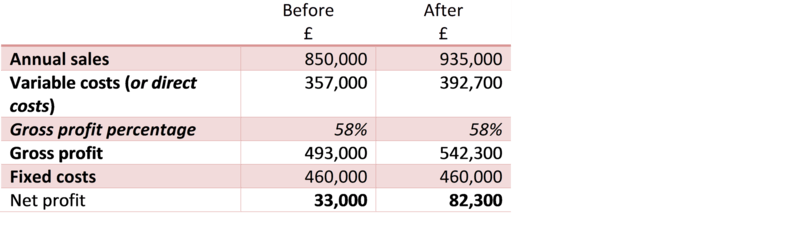

Remember, if Eddie wants to grow his business by 10% he could get his existing customers to buy more from him every time they do business.

For example, when he agrees the price for doing a film shoot he might then offer some enhancements such as creating a blooper reel, doing a multi camera shoot or something else that enhances the service and increases the order by 10%.

This is the impact doing this would have on Eddie’s profit:

Customers buying 10% more

Notice that these additional sales will increase the variable costs by 10% too.

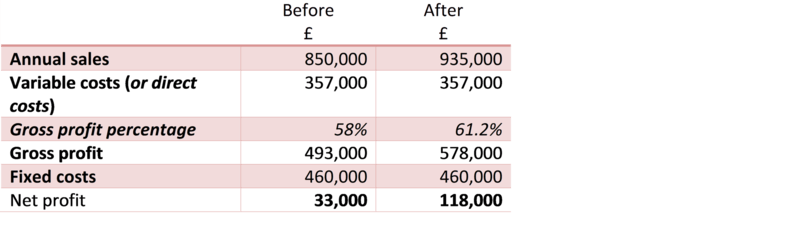

However, he could instead increase the amount his customers spend by increasing the price.

If he does this by increasing average prices by 10%, and assuming no resulting loss of customers, his profit will now look like this:

Increasing price by 10% without losing customers

Changing price does not impact on the cost structure. The impact on profit is much greater than increasing sales in other ways.

The latter increases Eddie’s profit by 249.4% to £82,300 which is a great result. But even more impressive is the 357.6% increase to £118,000 by changing average prices.Not only is the potential impact on profit much greater, it is also faster. In other words, to grow sales using any of the 3 sales drivers takes time.

To grow a business by 10% with a focus on winning new customers can easily take a year or more (unless you are a new business Start Up). In contrast, you can change your pricing structure tomorrow.

But there is a big problem

If you put your average prices up by 10% you will lose business. Possibly as much as 10% of customers. And possibly much more.

At least, that’s the common reaction.

However, the reality is likely to be very different. In most cases, the number of customers you lose from a price rise is much less than expected. Sometimes it’s even no loss of customers. And sometimes it results in an increase in new customers.

Of course, you may well be sceptical. And there is nothing wrong with healthy scepticism.

Very often, the number of customers you can afford to lose and maintain profits is higher than you might think.

For example, if Eddie increases his prices by 10% and loses 10% of his customers, his bottom-line profit will still increase by £27,200.

Why is that?

With a 10% increase in price and a 10% loss of customers, sales don’t change much (they would actually reduce by just 1%). Much more importantly, with 10% less customers to serve, those variable costs also reduce by 10%.

In fact, Eddie can afford to lose 14.71% of his customers and his profit won’t change. And that would still be a great result. Making the same profit but with 14.71% less customers, Eddie can work less hard for the same money.

Not only that. Think about which customers leave when you put your prices up. Is it those loyal customers who love what you do, are a joy to work with, give you the most – and most interesting – work and always pay you on time?

No. Those are the customers who will stay with you. The ones you lose are the ones who always moan and complain about your price. They are the ones who pay you late. In short, the customers you hate dealing with.

In contrast, when you cut prices you attract price shoppers. And the problem with price shoppers is, they have no loyalty. They are the first to leave you when someone else cheaper comes along. Here’s a simple rule:

Reducing your prices attracts the worst customers

Putting your prices up improves the quality of your customer base

I’ve shared with you some numbers for Eddie’s business. Every business is different. Your business is different. The results you would get depend upon your cost structure.

Nevertheless, you can build a mathematical model to describe your business. When you do this, you can see the impact on your profit from making changes to any of these 8 profit drivers.

If you don’t know how to build that mathematical model, speak to a specialist (like us :-) who can do this for you.

Get in touch today!

That just leaves one more driver.

The 9th driver

The final driver is a little different, but no less important.

The first 8 drivers can be built into a complex mathematical model; a model that predicts what happens to profit when you manage and change any of the drivers.

The final driver is to systemise everything. To create systems for improving each of the drivers of profits, e.g. customer service systems, selling systems, referral systems, pricing systems.

Quick summary of the 9 drivers of profit

Here are the 9 profit drivers (and the function of a business they fall within):

1. Getting more sales leads (Marketing)

2. Converting sales leads into customers (Sales)

3. Getting customers to spend more (Marketing)

4. Getting customers to spend more often (Marketing)

5. Getting customers to remain customers for longer (Customer Service)

6. Pricing for maximum profit (Pricing/Marketing)

7. Variable costs (Operational)

8. Fixed costs (Operational)

9. Systemise everything (Operational)

Which profit driver should you focus on?

You should work on all of them simultaneously. But if you were to pick one you should

always start with price.

Firstly, it is the most powerful lever in the profit equation, i.e. it has the biggest mathematical impact on profit. Secondly, it can have an immediate impact on profit.

You must also understand how each of the drivers impacts on other elements of the profit equation. Most businesses focus on getting more sales leads and winning more customers.

However, if the price is wrong (or by giving discounts to attract new customers) very often this can have a negative impact on profit.

I often come across business owners who are working way too hard, getting very stressed and not making enough money. They think the solution is to win new business.

However, the real problem is usually the wrong pricing. If your prices are too low, winning new customers simply compounds the problem… you just find yourself working harder and harder.

This is why pricing is so important.

Get your pricing right and you’ll see your profits rising significantly. Get it wrong and it’s a fast way to go out of business.

You must understand the numbers.

This is why you always start with the numbers before creating your pricing strategy.

Appreciate it's been a long post but hopefully has been valuable!

Would love to hear you pricing stories, feel free to share.

Very best

Reza