It's All A Big Lie

When I tell business owners they need to put their prices up they usually say, “You just don’t understand. My customers are price sensitive!”

There is a perception that most people are price sensitive. It’s one of the big pricing myths.

What is the difference between price sensitive and value sensitive?

There certainly are price sensitive people in society, but it’s much less than you probably think. Estimates by behavioural economists and price psychologists put it at between 14 – 20%. These are people for whom price is the sole determinant of whether to buy or not.

For example, the retired gentleman who eagerly awaits his free Sunday paper so he can cut out and collect the vouchers for a few pence off groceries at the local supermarket. Those people who shop in discount stores like Poundland where everything is £1. They are price sensitive.

And if they are your customer segment, then I agree; it is much harder to put your prices up.

However, the reality is most people are not price sensitive. They are value sensitive.

When we buy anything, we compare the benefit we get from that product or service and the cost to acquire it (the price).

If the benefit is greater than the price we make a profit on the deal. For most people, the size of the gap is more important than the price.

Let’s look at a couple of examples

Where do you buy your coffee from?

An increasing number of people buy their coffee from chains such as Starbucks, Costa Coffee and Peets. They happily pay £2 - £4 for a coffee. Are they crazy? You can get coffee at a fraction of the price from cheaper independent coffee shops, and even less if you buy instant coffee in a jar from the supermarket.

Of course, they’re not crazy.

I’m not crazy when I buy a Venti Latte from Starbucks. Yes, I pay a premium price. I pay that because there are things about Starbucks I value. I like the taste. I like the consistency. I like the predictability. I like the fact I can sit in Starbucks to work and get access to Wi-Fi.

I can get access (at certain tables) to a power supply. I can have a business meeting there. All this adds up to a great deal of value. The benefit to me of getting my coffee from Starbucks far outweighs the price I pay.

I’m value sensitive. Anyone who buys their coffee from Starbucks, or an equivalent coffee chain, by definition, cannot be price sensitive. A price sensitive person would not buy from Starbucks because there are cheaper ways of getting their coffee fix.

Starbucks don’t care because they are not looking to serve that segment of society who are price sensitive.

Do you own an Apple product, such as an iPhone, iPad, iPod or MacBook?

If so, once again, by definition, you cannot be price sensitive. A price sensitive person would not buy an iPhone because you can get a free basic phone as part of a low-price mobile phone contract for a few pounds per month. There are cheaper tablet devices, cheaper MP3 players and cheaper computers.

If you have customers who buy Apple products, or get their coffee from chains like Starbucks, they are value sensitive and not price sensitive.

That doesn’t mean price isn’t important. Price is always important. But it’s only one of the elements of the value equation. There are many other factors determining whether we buy or not.

Business owners are unaware of price failure

The reality is, most businesses that compete on price fail because (a) they don’t understand the maths, i.e. how many extra customers you need to win to compensate for lower prices, and (b) in the absence of appropriate pricing knowledge, price strategies and pricing systems they end up in a price war which few people win.

And once again, let’s consider Eddie’s business.

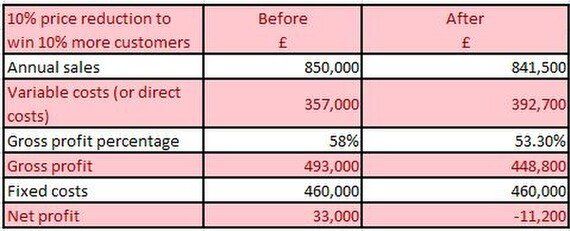

Imagine Eddie wants to grow his business. He wants more customers. He decides that by discounting his prices and using promotions so his average price is 10% lower, he will attract new customers and grow his market share. He thinks he’ll grow his customer base by 10%.

When he crunches the numbers, he will find this:

Oh dear! That’s not good. He’s just crashed his profit margins from 58% to 53.3%. And he’s killed his profit. He’s now making a loss.

In fact, for Eddie to be no worse off financially, he would actually have to win 20.83% more customers to compensate for the 10% price cut. That’s a lot of extra business Eddie is hoping to win.